Customs clearance

With PUREPROGRESS, you have a competent partner for Europe-wide customs clearance. Our specialists have the knowledge and experience to advise you in detail on all customs matters. In principle, we can offer customs clearance for all types of goods.

This includes, for example, the customs clearance of metal / glass / wood and plastic goods, live animals, vehicles such as trailers, cars, trucks, boats or airplanes; foodstuffs, hazardous goods, pharmaceutical products and other goods requiring authorization.

It therefore doesn’t matter whether the goods are transported as land freight, sea freight or air freight, we will be happy to take care of it for you. We have broken down the various customs clearance services by country for you below:

Customs clearance Switzerland

As a Swiss customs agency with its own offices directly at the various borders, we can offer customs clearance in all common Swiss customs procedures. We have our own offices on the Thayngen and St. Margrethen borders. We are represented by our partners at all other major Swiss borders. We can offer customs clearance and other related services for Swiss customs clearance in the following form:

– Swiss import customs declarations at almost all Swiss customs offices

– Swiss provisional import declarations

– Swiss export declarations/declarations

– Swiss Carnet A.T.A.

– Swiss ZAVV / free pass (temporary import for the purpose of re-export without change)

– Creation of T1 documents

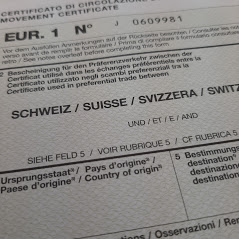

– Creation of Swiss movement certificates EUR.1

– Creation of additional forms (goods certificate, form 13.20A for vehicles to be registered for road traffic, customs clearance certificate 15.10 for watercraft)

– Procurement of proof of origin

– Applications and clarifications with customs authorities

– Advice and assistance with applications for customs numbers, permits, tariff quotas, etc.

In addition, we can also provide further customs clearance services. Although they are not Swiss procedures, the following services are often related to customs clearance in Switzerland:

– German export declarations (export accompanying document)

– German movement certificates (EUR.1)

– Clearance certificates– Import customs clearance to other countries

– Export accompanying documents from other countries

– T1 Documents from other countries

We will be happy to advise you on your customs clearance. We are represented at all major borders throughout Switzerland (with our own office or via partners).

Thayngen customs agency

We have our own customs office at the Swiss-German border. Our Thayngen customs agency will be happy to advise you on all relevant customs issues and any import duties / costs that may arise.

You can reach us Monday – Friday from 07:00 – 17:30 on site and by telephone on +41 (44) 512 14 35 as well as by e-mail at anfrage@pureprogress.ch or via the contact form

Our local address is:

PUREPROGRESS GmbH

Thayngen customs agency

Zollstr. 77

8240 Thayngen

Switzerland

Customs clearance Germany

Since 2009, almost all German customs declarations must be transmitted electronically to German customs via the ATLAS system using a software interface. With our customs software and our know-how, we can handle all the necessary steps for German imports and exports for you. This makes handling difficult customs applications and declarations child’s play for you.

You simply send us the available documents such as the commercial invoice, delivery bill and any other documents, let us know which service you require and we will take care of the rest. With us as your partner, the “traffic lights are green” and your goods cross the border quickly and easily. You are also welcome to call us for advice. Our services include the following activities:

– German import customs clearance at all German customs offices

– Application for inward processing (AV-Schein / Single Administrative Document)

– German export accompanying document at all German customs offices

– German movement certificates (EUR.1, A.TR)

– Other forms (e.g. clearance certificates)

– Procurement of supplier declarations and clarifications with manufacturers and general importers

– Applications and clarifications with German (main) customs offices

– Advice and assistance in applying for EORI numbers, permits, etc.

Customs clearance reference project

was able to drastically reduce its service costs thanks to our service:

The in-house customs department of a large German workshop chain contacted us regarding the preparation of customs documents. Due to the closure of several branches in Switzerland, we were asked to take over the entire preparation of the Swiss export declaration incl. Take over the creation of the transit document T1. The company did not have customs declarants with the appropriate knowledge of Swiss customs law, which is why it turned to us. The difficulty with customs clearance: The stores each had several thousand products in stock. These included every conceivable product in the industry, from nuts and bolts to mints, tires, lifts, engine oil and simple vehicle parts or stickers. In total, an export declaration and tariff classification had to be made for over 25,000 goods items. The customer had already provided us with the German export tariff numbers, but these do not match the correct Swiss tariff numbers. As a result, we had to apply a separate tariff for the goods.

With the help of its own software solutions, PUREPROGRESS was able to combine the more than 25,000 goods items into approx. 450 customs tariff numbers per store. This also included summarizing the product descriptions and determining the quantities required in the declaration. As a maximum of 100 customs tariff numbers may be listed per Swiss export declaration, each branch could be recorded under customs law in five documents (for approx. 450 tariff numbers) instead of the regular 40 documents per branch with 100 items each. This has drastically reduced the amount of work involved. The customer was thus able to save several thousand euros while complying with customs laws. The creation of the transit documents T1 incl. PUREPROGRESS also assumed liability for any import duties that may arise and handled them reliably.